Overview

You can use our Merchant API to create a payment flow you need. For example, you can design your own fully customized payment page and connect it to our Payment Gateway.

You can download Postman collection of some basic API methods below. Make sure to send requests as POST with attributes in the body.

Mandatory parameters

The mandatory presence of a parameter in a request/response may have the following values:

- Mandatory - the parameter must always be included. If it is not provided, an empty value should be passed, depending on the expected format;

- Optional - the parameter may be included or excluded, and its excessive inclusion will not cause a system error;

- Conditional - the parameter can either be included (be mandatory) or excluded, depending on one or more specified conditions.

The mandatory transmission of a parameter in the request/response description is indicated in the "Required" column.

Authentication

For merchant authentication in the payment gateway two methods can be used.

- Using login and password of the merchant's API user (account with

-apipostfix) received on registration. These values are passed inuserNameandpasswordparameters correspondingly (see the table below).

| Required | Name | Type | Description |

|---|---|---|---|

| Conditional | userName |

String [1..30] | Merchant 's API account login (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

| Conditional | password |

String [1..30] | Merchant's API account password (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

- Using a special token - you can request its value in the technical support service. In requests its value is passed in

tokenparameter (see the table below).

| Required | Name | Type | Description |

|---|---|---|---|

| Conditional | token |

String [1..256] | Value that is used for merchant authentication when requests are sent to the payment gateway (mandatory, unless userName and password are passed). If you pass this parameter, do not pass userName and password. |

API URLs

TEST: https://uat.dskbank.bg/payment/rest/

PROD: https://epg.dskbank.bg/payment/rest/

Errors

HTTP status codes:

200- in case of the Payment Gateway API calls the JSON payload from the response must be inspected to determine whether processing was successful or not. Success is indicated by either:

- thesuccessparameter value beingtrue

- theerrorCodeparameter value being0

If both parameters are present,successoverrideserrorCode.400- an internal error occurred in the system.404- error while calling API - URL is incorrect (does not exist).429- this code means that the system is overloaded. Most often the main reason is that the limit of requests per second or limit of simultaneous requests is reached. But it may also be due to the fact that the system as a whole is overloaded (regardless of your requests).500 or 502- this code means that something went wrong on our side.

If the request, associated with an order payment, is processed successfully, it does not directly mean that the payment itself was successful.

To determine whether the payment was successful or not, you may refer to the description of the request used, where the intepretation of the payment success is thoroughly described, or you may follow the rule of thumb here:

- Call getOrderStatusExtended.do;

- Check the

orderStatusfield in the response: the order is considered to be payed only if theorderStatusvalue is1or2.

API request signature

Facing insecure integration, you may be requested to implement an asymmetric request signature. Usually, this requirement is applied only if you carry out P2P/AFT/OCT requests.

To have a possibility to sign requests, you need to perform the following steps:

- Generate and upload a certificate.

- Calculate a hash and a signature using your private key and pass the generated hash (X-Hash) and the signature value (X-Signature) in the request header.

These steps are described below in details.

Generating and uploading a certificate

-

Generate 2048-bit RSA private key. The way of generation depends on privacy policy in your company. For example, you can do it using OpenSSL:

openssl genrsa -des3 -out private.key 2048 -

Generate public CSR (Certificate Signing Request) using the generated private key:

openssl req -key private.key -new -out public.csr -

Generate a certificate using the generated private key and CSR. The example of generating a certificate for 5 years:

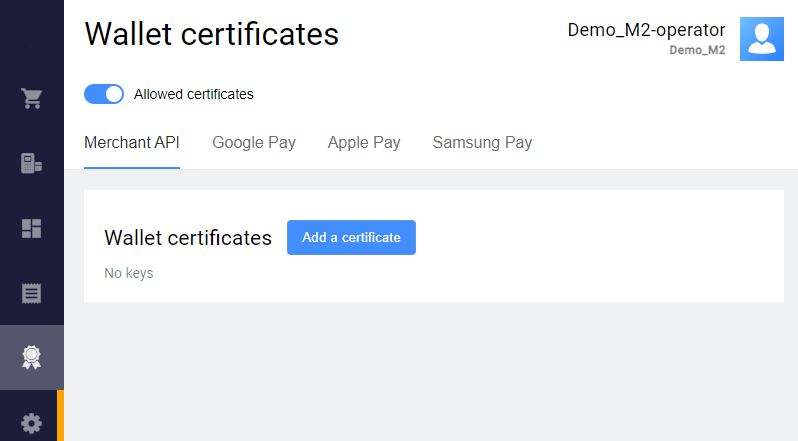

openssl x509 -signkey private.key -in public.csr -req -days 1825 -out public.cer Upload the generated certificate in the Personal Area. To do this, go to Wallet certificates > Merchant API, click Add a certificate and upload the generated public certificate.

Calculating a hash and a signature

-

Calculate SHA256 hash of the request body as follows:

- Use request body as a string (in our example it is

amount=10000&password=gcjgcW1&returnUrl=http&userName=signature-api). - Calculate SHA256 hash from this string, in raw bytes.

- Convert the raw bytes into base64 encoding.

- Use request body as a string (in our example it is

Generate a signature for the calculated SHA256 hash with RSA algorythm using the private key.

In our example we use the following private key with the password 12345:

-----BEGIN RSA PRIVATE KEY-----

Proc-Type: 4,ENCRYPTED

DEK-Info: DES-EDE3-CBC,C502560EDE8F82B7

O4+bY1Q1ZcXFLDGVE8s9G2iVISHR/c/IMZKZEjkBED/TbuOCUGVjcav2ZaZO2dO0

lm771N6JNB01uhJbTHScVQ6R0UnGezHFTcsJlAlBa9RQyOwujs4Pk6riOGnLliIs

urnTXD0oskBR1wLRA2kp8+V0UPOAMXQaoLxFGE/o8taDGSrkyIcYTBoh9o7ZBxvO

SqUWAt2vPbGVyc6XspyuVtgHgEctaJO+E26QTweqdpN5JITF+fDFPNwUrFHoho4N

pxpKRWbiCJSpbvbsvhdizkmfgvRw+qYJvTirF3JTfGr14DttudFwjm7sNrr0JILR

XPKDUhRyWjkthZM+oDjF2HwISAGkbxcpn4PU7Tywq0uax+5KCQQn2uz4jLM2P6+9

000cvVLwhMnoUdOxuISRXeOcOWVyTO1mPfKiWnHaoO4yS3Y36OCIOe9RHGP8TTmq

acb3LUIF30eQyk3KxH/tUB0ScPDKEKMiww13/Kcfr0JkdIe/BWCvV+hSQm38TLQe

bTFy+wnD9kHACCwTSVVSOO+rHgJGVIyLgnpClZKWQyyJ4clH7/cORA7mTmp85Ckx

IjV5Egu0bPPUMudOB5BnQ4u85RnqXavasgrLRA3JZM4+Jzl8MNy/fsFXnVBQLJJC

Wlz/B7S7W8sabRogFuiqkkPmXE/QcpdKQoY3yh748QqMSl8vkA6WgndyYv1EnDDl

jA5j7vSf0wKI8BHgdHBEWuEjn3X/s0S/BiPPI6puboYY90tYVJTWSQCR83QrMF3N

BIcMu4+RIYu6GWnPx9npZpt0858c670ZII56np24iMse3qgHCOZxsGOenK2x7ta6

163gvaD8bu8xoeQcGVfd6IMbXWVb0+z1hvWR5HWHSalof4lMzZrDsQDKc2UA0ygh

hA1+VAl1MAEHVLNCCmyG1SwRwg1PI7FfftW7YARngCZRWkJ1haj1fgy7rtYolrdv

lEz/vjFD6diABx67omGgfiJhWdiKIlzsYlX1SW7yaik/Uxf1j8gTFwY34y8ekVd9

6pQTzV2V/4a48ELZl4LvelLWyt1AB3AR+/fM7YG6LYIqlo+qnLtro7Bqu8RNTNRP

wcWCd04r/20ulFWMIH8pVa60C98pSdOXriWEI1KDLc0E/fCdhjW2kL+FTPLC7ORe

cuzmfI27+06P/BvLZq/FAVBrDAmkioKwe6XYzTjpK1p5jZ3IrNwjAiasY1MNxCRy

5ufhQwkW//d+VUdU5m8Sm30/kXe9UkxMaetXgzPxbB7+5QFFr0bi7D1MjIrJNtTx

5g5E+UfOhqrp8ztBht9csQeFYSYabyyGX4Lh7ymVWrKCVdHlJib3M36nvOjpV/lA

zf35sxFz9kaQqNK7xJdQ9Bx6TBUzLjpYhNry37vKk+SIB6Weo+LJ99mALMeX79CB

osRqZqX5yrZhaQ8bbpo981nvLy5xFnpRqCuSWVZrVMBq3LQLaOvaCeyGC0V+ZN0C

CU6lHlR6XQqd/IjoEN8+8aiVp6Ubw8FuD28TDaEvCltrX3ARL0xFpABsa42LgV1F

09Vi+ju7SSNDvbezN8q0EILq9xp/zNCVhMpyRCIXBq9fzHkyCZ5qMw==

-----END RSA PRIVATE KEY-----

and get the signature:

pJ/gM4PR1/mKGuIxMvTl5pYDDjJslb0BcXFnIxijFn5qKdPd7W+2ueoctziU7omnkYp01/BlracukH1GOPWMSO+9zKuTDdFueFm1utsS0zaPFU+dmc1niGDRWE0CbCXcti/rGSTDPsnR58mwqgVkbCWxKyCDtuo5LxiKPK9mzgWTUuJ8LX6f6u42MURi5tRG6a9dc8l/+J94g0YOk911R6Lqv2jcluEvZ9ZeMMt8hyxowb0eDaCHlussu2CAyqpE9V+EUAc81Jkwv96MMSsA6UnFwEaCV/k+kwYd0jHCx94m2yWX734p9cWsBW7Fr5F0zox9Yck4GOjqe9nJMMB9jQ==

3. Now you should pass the generated hash (X-Hash) and the signature value (X-Signature) in the request header. The request will look like this:

curl --request POST \

--url https://uat.dskbank.bg/payment/rest/register.do \

--header 'content-type: application/x-www-form-urlencoded' \

--header 'X-Hash: eYkMUF+xaYJhsETTIGsctl6DBNZha1ITN8muCcWQtZk=' \

--header 'X-Signature: pJ/gM4PR1/mKGuIxMvTl5pYDDjJslb0BcXFnIxijFn5qKdPd7W+2ueoctziU7omnkYp01/BlracukH1GOPWMSO+9zKuTDdFueFm1utsS0zaPFU+dmc1niGDRWE0CbCXcti/rGSTDPsnR58mwqgVkbCWxKyCDtuo5LxiKPK9mzgWTUuJ8LX6f6u42MURi5tRG6a9dc8l/+J94g0YOk911R6Lqv2jcluEvZ9ZeMMt8hyxowb0eDaCHlussu2CAyqpE9V+EUAc81Jkwv96MMSsA6UnFwEaCV/k+kwYd0jHCx94m2yWX734p9cWsBW7Fr5F0zox9Yck4GOjqe9nJMMB9jQ==' \

--data 'amount=10000&password=gcjgcW1&returnUrl=http&userName=signature-api'The request should meet the following requirements:

- All the request parameters are included into the request body (not into the URL).

-

If the request parameters are in JSON format, then the following header should be used:

--header 'content-type: application/json' -

If the request parameters are in Query format (like

parameterA=valueA¶meterB=valueB), then the following header should be used:--header 'content-type: application/x-www-form-urlencoded' The request contains correct login and password of the API user.

The

X-Hashheader contains SHA256 hash of the request body (calculated at step 1).The

X-Signatureheader contains the signature for the calculated SHA256 hash with RSA algorythm using the private key (generated at step 2).

Java code example

Below is the Java code example that loads a private key, calculates SHA256 hash, signs it using the private key with the password 12345, and then sends a correct register.do request:

import javax.net.ssl.HttpsURLConnection;

import java.io.BufferedReader;

import java.io.DataOutputStream;

import java.io.InputStream;

import java.io.InputStreamReader;

import java.net.URL;

import java.nio.file.Files;

import java.nio.file.Paths;

import java.security.KeyStore;

import java.security.MessageDigest;

import java.security.PrivateKey;

import java.security.Signature;

import java.util.Base64;

import static java.net.HttpURLConnection.HTTP_OK;

public class SimpleSignatureExample {

// This example is not production ready. It just shows how to use signatures in API.

public static void main(String[] args) throws Exception {

// load private key from jks

KeyStore ks = KeyStore.getInstance("JKS");

char[] pwd = "123456".toCharArray();

ks.load(Files.newInputStream(Paths.get("/path/to/certificates.jks")), pwd);

PrivateKey privateKey = (PrivateKey) ks.getKey("111111", pwd);

// Sign

String httpBody = "amount=10000&password=gcjgcW1&returnUrl=http&userName=signature-api";

MessageDigest digest = MessageDigest.getInstance("SHA-256");

Signature signature = Signature.getInstance("SHA256withRSA");

signature.initSign(privateKey);

byte[] sha256 = digest.digest(httpBody.getBytes());

signature.update(sha256);

byte[] sign = signature.sign();

// Send

Base64.Encoder encoder = Base64.getEncoder();

HttpsURLConnection connection = (HttpsURLConnection) new URL("https://<YOUR_DOMAIN>/payment/rest/register.do").openConnection();

connection.setDoOutput(true);

connection.setDoInput(true);

connection.setRequestMethod("POST");

connection.addRequestProperty("content-type", "application/x-www-form-urlencoded");

connection.addRequestProperty("X-Hash", encoder.encodeToString(sha256));

connection.addRequestProperty("X-Signature", encoder.encodeToString(sign));

connection.addRequestProperty("Content-Length", String.valueOf(httpBody.getBytes().length));

try (final DataOutputStream outputStream = new DataOutputStream(connection.getOutputStream())) {

outputStream.write(httpBody.getBytes());

outputStream.flush();

}

connection.connect();

InputStream inputStream = connection.getResponseCode() == HTTP_OK ? connection.getInputStream() : connection.getErrorStream();

BufferedReader reader = new BufferedReader(new InputStreamReader(inputStream));

String line;

while ((line = reader.readLine()) != null) {

System.out.println(line);

}

}

}Python code example

Below is the Python code example that generates the signature:

import OpenSSL

from OpenSSL import crypto

import base64

from hashlib import sha256

key_file = open("./priv.pem", "r")

key = key_file.read()

key_file.close()

if key.startswith('-----BEGIN '):

pkey = crypto.load_privatekey(crypto.FILETYPE_PEM, key)

else:

pkey = crypto.load_pkcs12(key, password).get_privatekey()

data = “amount=2000¤cy=978&userName=test_user&password=test_user_password&returnUrl=https%3A%2F%2Fmybestmerchantreturnurl.com&description=my_first_order&language=en”

sha256_hash = sha256(data.encode()).digest()

base64_hash = base64.b64encode(sha256_hash)

print(base64_hash)

sign = OpenSSL.crypto.sign(pkey, sha256_hash, "sha256")

signed_base64 = base64.b64encode(sign)

print(signed_base64)The private key file for the Python example should have the format:

-----BEGIN PRIVATE KEY-----

MIIEvwIBADANBgkqhkiG9w0BAQEFAASCBKkwggSlAgEAAoIBAQDdpOwhY/p9x0WmBd3HaDfCD+KYung3M8Cxrw0ozF+h//GltRdnkJD7ejsBDB6/YeIVXZeU3AyqWvsi/IfeHwnokGxVg2IMw8OPacY6o1x7W0EQtfRoZa2Cn2PMCpZhEHlIVraXZDDeg4HY26YP0FZxRbpNnpXhGbiop+Bq0wHeE3JIk53cRmwYhxdxMmvFpgNd6C3dYhmnQqLv6WSpVNDFbQxBVU+JDNyR9FQwB1dU2MadgYwFJnEssbhUkM+sXAC4Wv3qhcZek6MWeWsbFIIlyTPa1T3yrWSXIb4qFJEro4pRMmwQ72qG02p8EPx1tlveQo22TojV9WbTPtaVwQtxAgMBAAECggEBANheTGkYOYsZwgMdzPAB7BSU/0bLGdoBuoV6dqUyRdVWjqaOTwe519625uzR0R5RRqxGzlfyLKcM5Aa2cUhEEp8mhatA87G0Va8lue66VOjTH4RZq/tR7v0J7hlc6Ipe05brl5nYo+BEjriNS+I6Jnizcfid7IBvZJW4NFr0G+mWTxl2BhUK/Mk895n8hg9QtgSRoMNO4jK2f0vJrH4hBHehTYpjHx+QhbUyIvsp60bEnNOXzl054TuWBVCYAQHcHTTZowWMY0s1Z0kGNxwsqQm4amW/v+1EqCF4fjRDrU6v/kjDKxGFx9GJUktKZAe2T8e2LySjgGpJO5g4AdxIVpUCgYEA8x9te+i2ijxoS3kIUSwXaPq5EdKGWGl5mW8KZHzmt9LB/CqTKvSOiDkMGoAx/76t5QmKOYojP+Vsc2XdfQfhT6d00MGTdiPBd+8//MmQQ07/D1/PV58Jd1O8bQFU4fZCMpQl/8Azp9ix/NEx0sHDv2KigLfFMBVGeJxwSoU2JzMCgYEA6WJC0BDTA9vx+i+p9i/41f7ozpQuYey5sxdZa2emOSYen6ptxUFLAYXMxVDaBJ89PMUa8GzWoXHhgXzbuRJk74IzUhWgPpneS4HTr5KDStJh2TqWWVLwEIgLwxvtuw0i9uSEU64D/Czzm801lrOhVgmZsWwNpFtP8ujz0v84MssCgYEA1P4YhbB3kx2e5VfwgGSXUcIttr5wMi6deF0+hpCh9DNw/QEzkzNTV2ZbAzCCHSKo5/n2nbg2b3kIDQUWCL6JlqYHAghErwBeMztoHIddmoovjAGM/Z93xJGYhwremWOL1RHTRH7XAlomfG2tL43PdvDrmsbkut44sdujyLVxnt8CgYBirK3tBMADKLJVgmOM+FlwORe7iAFYW9tj8iJXe/pWvVxDS66fsOyCl0ytvHKBc8ZTdE7gilPw7JJYyi6oQDO25EjIkuYusaXALQMQf5TNRMgkLVY2LA/eHXdDpgJMjNBUrOeZ7cA3ldXl8MyQjCBRnTuDPVlDPWw/GulEM65SIwKBgQDIEv8XK2YBkZrr+0fZSFTQAeK4R7Ve3z4hbpHhJi41YanCNaEWoeYAuQd6/b/QLwABllvfJBDYCNnF8heUxqISpyWd+FZ8nhZtxBoKj5l80czTcutIz/M+ETcvl8FqnMBsoCdp1wodqaLkOx6DIldgKLze6AqKXl5lHUsU4mvVqg==

-----END PRIVATE KEY-----

Order registration

Order registration

To register an order, use https://uat.dskbank.bg/payment/rest/register.do request.

When sending the request, you should use the header:

Content-Type: application/x-www-form-urlencoded

Request parameters

| Required | Name | Type | Description |

|---|---|---|---|

| Conditional | userName |

String [1..30] | Merchant 's API account login (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

| Conditional | password |

String [1..30] | Merchant's API account password (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

| Conditional | token |

String [1..256] | Value that is used for merchant authentication when requests are sent to the payment gateway (mandatory, unless userName and password are passed). If you pass this parameter, do not pass userName and password. |

| Mandatory | orderNumber |

String [1..36] | Order number (ID) in the merchant's system, must be unique for each order. |

| Mandatory | amount |

Integer [0..12] | Payment amount in minor currency units (e.g. in cents). |

| Mandatory | currency |

String [3] | ISO 4217 encoded currency key. If not specified, the default value is used. Only digits are allowed. |

| Mandatory | returnUrl |

String [1..512] | The address to which the user will be redirected if the payment is successful. The address must be specified in full including the protocol used (for example, https://mybestmerchantreturnurl.com instead of mybestmerchantreturnurl.com). Otherwise, the user will be redirected to the address of the following type https://uat.dskbank.bg/payment/<merchant_address>. |

| Optional | failUrl |

String [1..512] | The address to which the user is to be redirected in case of a failed payment. The address must be specified in full including the protocol used (for example, https://mybestmerchantreturnurl.com instead of mybestmerchantreturnurl.com). Otherwise, the user will be redirected to the address of the following type https://uat.dskbank.bg/payment/<merchant_address>. |

| Optional | dynamicCallbackUrl |

String [1..512] | This parameter allows you to use the functionality of sending callback notifications dynamically. Here you can pass the address to which all "payment" callback notifications activated for the merchant will be sent. "Payment" notifications are callback notifications related to the following events: successful hold, payment declined by timeout, cardpresent payment is declined, successful debit, refund, cancellation. At the same time, callback notifications activated for the merchant that are not related to payments (enabling/disabling a stored credential, storing a credential) will be sent to a static address for callbacks. Whether the parameter is mandatory or not depends on the merchant configuration on Payment Gateway side. |

| Optional | description |

String [1..598] | Order description in any format. To enable sending this field to the processing system, contact the technical support service. It is not allowed to fill this parameter with personal data or payment data (card numbers, etc.). This requirement is due to the fact that the order description is not masked in Merchant Portal and log files. |

| Optional | language |

String [2] | ISO 639-1 encoded language key. If the language is not specified, the default language specified in the store settings is used. Supported languages: en,ru,el,ro,bg,pt,sw,hu,it,pl,de,fr,kh,cn,es,ka,da,et,fi,lt,lv,nl,sv. |

| Optional | ip |

String [1..39] | Buyer's IP address. IPv6 is supported in all requests. (up to 39 characters). |

| Optional | clientId |

String [0..255] | Customer number (ID) in the merchant's system — up to 255 characters. Used to implement the functionality of stored-credential transactions. Can be returned in the response if the merchant is allowed to store credentials. Specifying this parameter in stored-credential transactions is mandatory. Otherwise, a payment will be unsuccessful. |

| Optional | merchantLogin |

String [1..255] | To register an order on behalf of another merchant, specify the merchant's API account login in this parameter. Can be used only if you have the permission to see the transactions of other merchants or if the specified merchant is your child merchant. |

| Optional | cardholderName |

String [1..150] | Cardholder's name in Latin characters. If it's passed, it will be displayed on the payment page. |

| Optional | jsonParams |

Object | A set of additional free-form attributes, structure:jsonParams={"param_1_name":"param_1_value",...,"param_n_name":"param_n_value"}Can be passed to the Processing Center for further processing (additional configuration required - contact support). Some predefined jsonParams attributes:

|

| Optional | sessionTimeoutSecs |

Integer [1..9] | Order lifetime in seconds. If the parameter is not specified, the value specified in the merchant settings or the default value (1200 seconds = 20 minutes) will be used. If the request contains expirationDate, the value of sessionTimeoutSecs is not taken into account. |

| Optional | expirationDate |

String [19] | Date and time of the order expiry. Format used: yyyy-MM-ddTHH:mm:ss.If this parameter is not passed in the request, sessionTimeoutSecs is used to define the expiry of the order. |

| Optional | bindingId |

String [1..255] | Identifier of an already existing stored credential. This is the card ID tokenized by the Gateway. Can be used only if the merchant has the permission to work with stored credentials. If this parameter is passed in this request, it means that:

|

| Optional | features |

String | Features of the order. To specify multiple features, use this parameter several times in one request. As an example, below are the possible values.

|

| Optional | postAddress |

String [1..255] | Delivery address. |

| Optional | orderBundle |

Object | Object containing cart of items. The description of the nested elements is given below. |

| Optional | feeInput |

Integer [0..8] | Fee amount in minimum currency units. Must be enabled by respective Merchant-level permission in the Gateway. |

| Optional | email |

String [1..40] | Email to be displayed on the payment page. Customer's email must be passed if client notification is configured for the merchant. Example: client_mail@email.com.The email will not be validated on registration. It will be later validated on payment. |

| Optional | mcc |

Integer [4] | Merchant Category Code. Using this parameter requires a special permission. You can use only the values from the predefined list of allowed MCC values. Contact the support team for details. |

| Optional | mvv |

String [1..10] | Merchant verification value from Mastercard for tokenized transactions. To pass this parameter, a special setting must be enabled (contact technical support). |

| Optional | paymentFacilitator |

Object | A block with the parameters of a payment facilitator, i.e. a merchant who allows several submerchants to accept payments under its account. This parameter is used if a special setting is enabled (contact the support team). See nested parameters. |

| Optional | billingPayerData |

Object | A block with the client's registration data (address, postal code) necessary for passing the address verification within the AVS/AVV services. Mandatory if the feature is enabled for the merchant on Payment Gateway side. See nested parameters. |

| Optional | shippingPayerData |

Object | Object containing customer delivery data. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | preOrderPayerData |

Object | Object containing pre-order data. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | orderPayerData |

Object | Object containing data about the order payer. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | billingAndShippingAddressMatchIndicator |

String [1] | Indicator for matching the cardholder's billing address and shipping address. This parameter is used for further 3DS authentication of the customer. Possible values:

|

Below are the parameters of the billingPayerData block (data about the client registration address).

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | billingCity |

String [0..50] | The city registered on a specific card of the Issuing Bank. |

| Optional | billingCountry |

String [0..50] | The country registered on a specific card of the Issuing Bank. Format: ISO 3166-1 (Alpha 2 / Alpha 3 / Number-3) or the country name. We recommend to pass a two/three-letter ISO country code. |

| Optional | billingAddressLine1 |

String [0..50] | The address registered on a specific card of the Issuing Bank (A payer’s address). Line 1. Mandatory to be passed in order AVS verification works. |

| Optional | billingAddressLine2 |

String [0..50] | The address registered on a specific card of the Issuing Bank. Line 2. |

| Optional | billingAddressLine3 |

String [0..50] | The address registered on a specific card of the Issuing Bank. Line 3. |

| Optional | billingPostalCode |

String [0..9] | Postal code registered on a specific card of the Issuing Bank. Mandatory to be passed in order AVS verification works. |

| Optional | billingState |

String [0..50] | The state registered on a specific card of the Issuing Bank. Format: full ISO 3166-2 code, its part, or the state/region name. Can contain Latin characters only. We recommend to pass a two-letter ISO state code. |

| Mandatory | payerAccount |

String [1..32] | Payer's account number. |

| Optional | payerLastName |

String [1..64] | Payer's last name. |

| Optional | payerFirstName |

String [1..35] | Payer's first name. |

| Optional | payerMiddleName |

String [1..35] | Payer's middle name. |

| Optional | payerCombinedName |

String [1..99] | Payer's full name. |

| Optional | payerIdType |

String [1..8] | Type of the payer's identifying document provided. Allowed values:

|

| Optional | payerIdNumber |

String [1..99] | Number of the payer's identifying document provided. |

| Optional | payerBirthday |

String [1..20] | Payer's birth date in the YYYYMMDD format. |

Description of parameters in shippingPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | shippingCity |

String [1..50] | The customer's city (from the delivery address) |

| Optional | shippingCountry |

String [1..50] | The customer's country |

| Optional | shippingAddressLine1 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingAddressLine2 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingAddressLine3 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingPostalCode |

String [1..16] | The customer's zip code for delivery |

| Optional | shippingState |

String [1..50] | Customer's state/region (from delivery address) |

| Optional | shippingMethodIndicator |

Integer [2] | Shipping Method Indicator. Possible values:

|

| Optional | deliveryTimeframe |

Integer [2] | Product delivery timeframe. Possible values:

|

| Optional | deliveryEmail |

String [1..254] | Target email address for delivery of digital distribution. Note that it is preferrable to pass the email in a separate email parameter of the request. The deliveryEmail parameter specified in this block is only used to fill MerchantRiskIndicator during 3DS authorization. |

Description of parameters in preOrderPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | preOrderDate |

String [10] | Expected date when delivery will be available (for pre-ordered purchases), in the format YYYYYYMMDD. |

| Optional | preOrderPurchaseInd |

Integer [2] | Indicator of a customer placing an order for available or future delivery. Possible values:

|

| Optional | reorderItemsInd |

Integer [2] | An indicator that the customer is rebooking a previously paid delivery as part of a new order. Possible values:

|

Description of parameters in orderPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | homePhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

|

| Optional | workPhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

|

| Conditional | mobilePhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

For payment by VISA with 3DS authorization, it is necessary to specify either phone or email of the cardholder. If you have a setting to display phone number on the payment page and have specified an invalid number, the customer will have a possibility to correct it on the payment page. |

Description of parameters in orderBundle object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | orderCreationDate |

String [19] | Order creation date in the following format: YYYY-MM-DDTHH:MM:SS. |

| Optional | customerDetails |

Object | Block containing customer attributes. The description of the tag attributes is given below. |

| Mandatory | cartItems |

Object | Object containing cart items attributes. The description of nested elements is given below. |

Description of parameters in customerDetails object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | contact |

String [0..40] | Customer's preferred way of communication. |

| Optional | fullName |

String [1..100] | Payer's full name. |

| Optional | passport |

String [1..100] | Customer's passport serial number in the following format: 2222888888. |

| Optional | deliveryInfo |

Object | Object containing delivery address attributes. The description of the nested elements is given below. |

Description of parameters in deliveryInfo object.

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | deliveryType |

String [1..20] | Delivery method. |

| Mandatory | country |

String [2] | Two letter code of the country of delivery. |

| Mandatory | city |

String [0..40] | City of destination. |

| Mandatory | postAddress |

String [1..255] | Delivery address. |

Description of parameters in cartItems object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | items |

Object | An element of the array containing cart item attributes. The description of the nested elements is given below. |

Description of parameters in items object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | positionId |

Integer [1..12] | Unique product identifier in the cart. |

| Mandatory | name |

String [1..255] | Name or the description of an item in any format. |

| Optional | itemDetails |

Object | Object containing the parameters describing an item. The description of the nested elements is given below. |

| Mandatory | quantity |

Object | Element describing the total of items of one positionId and its unit of measurement. The description of the nested elements is given below. |

| Optional | itemAmount |

Integer [1..12] | The total cost of all instances of one positionId specified in minor denomination of the currency. itemAmount must be passed only if the itemPrice parameter has not been passed. Otherwise passing of itemAmount is not required. If both parameters itemPrice and itemAmount are passed in the request, then itemAmount shall be equal itemPrice * quantity, otherwise the request will return an error. |

| Optional | itemPrice |

Integer [1..18] | Total cost of instance of one positionId specified in minor currency units. |

| Optional | itemCurrency |

Integer [3] | ISO 4217 currency code. If the parameter is not specified, it is considered to be equal to the Order currency. |

| Optional | itemCode |

String [1..100] | Number (identifier) of an item in the store system. |

Description of parameters in quantity object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | value |

Number [1..18] | Number of items in one positionId. Use a decimal point as a separator in fractions. Maximal number of decimal places is 3. |

| Mandatory | measure |

String [1..20] | The unit of measurement for the quantity of item instances. |

Description of parameters in itemDetails object.

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | itemDetailsParams |

Object | Parameter describing additional information regarding a line item. The description of the nested elements is given below. |

Description of parameters in itemDetailsParams object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | value |

String [1..2000] | Additional item info. |

| Mandatory | name |

String [1..255] | Name of the parameter describing the details of an item |

Description of parameters in the paymentFacilitator object:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | pfId |

String [1..11] | Payment facilitator identifier. |

| Mandatory | name |

String [1..40] | Payment facilitator name. |

| Optional | isoId |

String [1..11] | ISO identifier. |

| Mandatory | subMerchants |

Array of objects | The array of objects with the additional information about submerchants. See nested parameters below. |

Parameters of an object in subMerchants array:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | subMerchantId |

String [1..20] | Submerchant identifier. |

| Mandatory | name |

String [1..40] | Submerchant name. |

| Mandatory | address |

Object | A block with information about submerchant address. See nested parameters below. |

Parameters of the address object:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | city |

String [1..50] | Submerchant city. |

| Mandatory | postalCode |

String [1..16] | Submerchant postal code. |

| Mandatory | country |

Integer [2] | Submerchant country code in ISO 3166-1 format. |

| Optional | street |

String [1..40] | Submerchant street. |

Example of paymentFacilitator object:

"paymentFacilitator" :{

"pfId": "PF123456",

"name": "Payment Facilitator Name",

"isoId": "ISO789",

"subMerchants": [

{

"subMerchantId": "SM001",

"name": "Sub Merchant 1",

"address": {

"city": "City 1",

"postalCode": "101000",

"country": "US",

"street": "Street 1"

}

},

{

"subMerchantId": "SM002",

"name": "Sub Merchant 2",

"address": {

"city": "City 2",

"postalCode": "190000",

"country": "US",

"street": "Street 2"

}

}

]

}Response parameters

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | errorCode |

String [1..2] | Information parameter in case of an error, which may have different code values:

|

| Optional | errorMessage |

String [1..512] | Information parameter that is an error description in a case of error occurance. errorMessage value can vary, so it should not be hardcoded. Language of the description is set in language parameter of the request. |

| Optional | formUrl |

String [1..512] | URL of the payment form, to which a customer will be redirected The URL is not returned if the registration of the order fails due to an error specified in errorCode. |

| Optional | orderId |

String [1..36] | Order number in the payment gateway. Unique within the payment gateway. |

Examples

Request example

curl --request POST \

--url https://uat.dskbank.bg/payment/rest/register.do \

--header 'content-type: application/x-www-form-urlencoded' \

--data amount=123456 \

--data userName=test_user \

--data password=test_user_password \

--data orderNumber=1234567890ABCDEF \

--data returnUrl=https://mybestmerchantreturnurl.com \

--data failUrl=https://mybestmerchantfailurl.com \

--data email=test@test.com \

--data clientId=259753456 \

--data features=FORCE_SSL \

--data features=FORCE_TDS \

--data language=en \

--data 'jsonParams={"param_1_name":"param_1_value","param_2_name":"param_2_value"}'Response example - success

{

"orderId": "01491d0b-c848-7dd6-a20d-e96900a7d8c0",

"formUrl": "https://uat.dskbank.bg/payment/payment/merchants/ecom/payment_en.html?mdOrder=01491d0b-c848-7dd6-a20d-e96900a7d8c0"

}Response example - fail

{

"errorCode": "1",

"errorMessage": "Order number is duplicated, order with given order number is processed already"

}Order pre-authorization

The method used for registration of an order with preauthorization is https://uat.dskbank.bg/payment/rest/registerPreAuth.do.

When sending the request, you should use the header:

Content-Type: application/x-www-form-urlencoded

Request parameters

| Required | Name | Type | Description |

|---|---|---|---|

| Conditional | userName |

String [1..30] | Merchant 's API account login (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

| Conditional | password |

String [1..30] | Merchant's API account password (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

| Conditional | token |

String [1..256] | Value that is used for merchant authentication when requests are sent to the payment gateway (mandatory, unless userName and password are passed). If you pass this parameter, do not pass userName and password. |

| Mandatory | orderNumber |

String [1..36] | Order number (ID) in the merchant's system, must be unique for each order. |

| Mandatory | amount |

Integer [0..12] | Payment amount in minor currency units (e.g. in cents). |

| Mandatory | currency |

String [3] | ISO 4217 encoded currency key. If not specified, the default value is used. Only digits are allowed. |

| Mandatory | returnUrl |

String [1..512] | The address to which the user will be redirected if the payment is successful. The address must be specified in full including the protocol used (for example, https://mybestmerchantreturnurl.com instead of mybestmerchantreturnurl.com). Otherwise, the user will be redirected to the address of the following type https://uat.dskbank.bg/payment/<merchant_address>. |

| Optional | failUrl |

String [1..512] | The address to which the user is to be redirected in case of a failed payment. The address must be specified in full including the protocol used (for example, https://mybestmerchantreturnurl.com instead of mybestmerchantreturnurl.com). Otherwise, the user will be redirected to the address of the following type https://uat.dskbank.bg/payment/<merchant_address>. |

| Optional | dynamicCallbackUrl |

String [1..512] | This parameter allows you to use the functionality of sending callback notifications dynamically. Here you can pass the address to which all "payment" callback notifications activated for the merchant will be sent. "Payment" notifications are callback notifications related to the following events: successful hold, payment declined by timeout, cardpresent payment is declined, successful debit, refund, cancellation. At the same time, callback notifications activated for the merchant that are not related to payments (enabling/disabling a stored credential, storing a credential) will be sent to a static address for callbacks. Whether the parameter is mandatory or not depends on the merchant configuration on Payment Gateway side. |

| Optional | description |

String [1..598] | Order description in any format. To enable sending this field to the processing system, contact the technical support service. It is not allowed to fill this parameter with personal data or payment data (card numbers, etc.). This requirement is due to the fact that the order description is not masked in Merchant Portal and log files. |

| Optional | ip |

String [1..39] | Buyer's IP address. IPv6 is supported in all requests. (up to 39 characters). |

| Optional | language |

String [2] | ISO 639-1 encoded language key. If the language is not specified, the default language specified in the store settings is used. Supported languages: en,ru,el,ro,bg,pt,sw,hu,it,pl,de,fr,kh,cn,es,ka,da,et,fi,lt,lv,nl,sv. |

| Optional | clientId |

String [0..255] | Customer number (ID) in the merchant's system — up to 255 characters. Used to implement the functionality of stored-credential transactions. Can be returned in the response if the merchant is allowed to store credentials. Specifying this parameter in stored-credential transactions is mandatory. Otherwise, a payment will be unsuccessful. |

| Optional | merchantLogin |

String [1..255] | To register an order on behalf of another merchant, specify the merchant's API account login in this parameter. Can be used only if you have the permission to see the transactions of other merchants or if the specified merchant is your child merchant. |

| Optional | cardholderName |

String [1..150] | Cardholder's name in Latin characters. If it's passed, it will be displayed on the payment page. |

| Optional | jsonParams |

Object | A set of additional free-form attributes, structure:jsonParams={"param_1_name":"param_1_value",...,"param_n_name":"param_n_value"}Can be passed to the Processing Center for further processing (additional configuration required - contact support). Some predefined jsonParams attributes:

|

| Optional | sessionTimeoutSecs |

Integer [1..9] | Order lifetime in seconds. If the parameter is not specified, the value specified in the merchant settings or the default value (1200 seconds = 20 minutes) will be used. If the request contains expirationDate, the value of sessionTimeoutSecs is not taken into account. |

| Optional | expirationDate |

String [19] | Date and time of the order expiry. Format used: yyyy-MM-ddTHH:mm:ss.If this parameter is not passed in the request, sessionTimeoutSecs is used to define the expiry of the order. |

| Optional | bindingId |

String [1..255] | Identifier of an already existing stored credential. This is the card ID tokenized by the Gateway. Can be used only if the merchant has the permission to work with stored credentials. If this parameter is passed in this request, it means that:

|

| Optional | features |

String | Features of the order. To specify multiple features, use this parameter several times in one request. As an example, below are the possible values.

|

| Optional | autocompletionDate |

String [19] | The date and time when the two-phase payment must be completed automatically in the following format: 2025-12-29T13:02:51. The used timezone is UTC+0. To enable sending this field to the processing system, contact your technical support service. |

| Optional | autoReverseDate |

String [19] | The date and time when the two-phase payment must be reversed automatically in the following format: 2025-06-23T13:02:51. The used timezone is UTC+0. To enable sending this field to the processing system, contact your technical support service. |

| Optional | postAddress |

String [1..255] | Delivery address. |

| Optional | orderBundle |

Object | Object containing cart of items. The description of the nested elements is given below. |

| Optional | feeInput |

Integer [0..8] | Fee amount in minimum currency units. Must be enabled by respective Merchant-level permission in the Gateway. |

| Optional | email |

String [1..40] | Email to be displayed on the payment page. Customer's email must be passed if client notification is configured for the merchant. Example: client_mail@email.com.The email will not be validated on registration. It will be later validated on payment. |

| Optional | mcc |

Integer [4] | Merchant Category Code. Using this parameter requires a special permission. You can use only the values from the predefined list of allowed MCC values. Contact the support team for details. |

| Optional | mvv |

String [1..10] | Merchant verification value from Mastercard for tokenized transactions. To pass this parameter, a special setting must be enabled (contact technical support). |

| Optional | paymentFacilitator |

Object | A block with the parameters of a payment facilitator, i.e. a merchant who allows several submerchants to accept payments under its account. This parameter is used if a special setting is enabled (contact the support team). See nested parameters. |

| Optional | billingPayerData |

Object | A block with the client's registration data (address, postal code) necessary for passing the address verification within the AVS/AVV services. Mandatory if the feature is enabled for the merchant on Payment Gateway side. See nested parameters. |

| Optional | shippingPayerData |

Object | Object containing customer delivery data. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | preOrderPayerData |

Object | Object containing pre-order data. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | orderPayerData |

Object | Object containing data about the order payer. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | billingAndShippingAddressMatchIndicator |

String [1] | Indicator for matching the cardholder's billing address and shipping address. This parameter is used for further 3DS authentication of the customer. Possible values:

|

Below are the parameters of the billingPayerData block (data about the client registration address).

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | billingCity |

String [0..50] | The city registered on a specific card of the Issuing Bank. |

| Optional | billingCountry |

String [0..50] | The country registered on a specific card of the Issuing Bank. Format: ISO 3166-1 (Alpha 2 / Alpha 3 / Number-3) or the country name. We recommend to pass a two/three-letter ISO country code. |

| Optional | billingAddressLine1 |

String [0..50] | The address registered on a specific card of the Issuing Bank (A payer’s address). Line 1. Mandatory to be passed in order AVS verification works. |

| Optional | billingAddressLine2 |

String [0..50] | The address registered on a specific card of the Issuing Bank. Line 2. |

| Optional | billingAddressLine3 |

String [0..50] | The address registered on a specific card of the Issuing Bank. Line 3. |

| Optional | billingPostalCode |

String [0..9] | Postal code registered on a specific card of the Issuing Bank. Mandatory to be passed in order AVS verification works. |

| Optional | billingState |

String [0..50] | The state registered on a specific card of the Issuing Bank. Format: full ISO 3166-2 code, its part, or the state/region name. Can contain Latin characters only. We recommend to pass a two-letter ISO state code. |

| Mandatory | payerAccount |

String [1..32] | Payer's account number. |

| Optional | payerLastName |

String [1..64] | Payer's last name. |

| Optional | payerFirstName |

String [1..35] | Payer's first name. |

| Optional | payerMiddleName |

String [1..35] | Payer's middle name. |

| Optional | payerCombinedName |

String [1..99] | Payer's full name. |

| Optional | payerIdType |

String [1..8] | Type of the payer's identifying document provided. Allowed values:

|

| Optional | payerIdNumber |

String [1..99] | Number of the payer's identifying document provided. |

| Optional | payerBirthday |

String [1..20] | Payer's birth date in the YYYYMMDD format. |

Description of parameters in shippingPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | shippingCity |

String [1..50] | The customer's city (from the delivery address) |

| Optional | shippingCountry |

String [1..50] | The customer's country |

| Optional | shippingAddressLine1 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingAddressLine2 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingAddressLine3 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingPostalCode |

String [1..16] | The customer's zip code for delivery |

| Optional | shippingState |

String [1..50] | Customer's state/region (from delivery address) |

| Optional | shippingMethodIndicator |

Integer [2] | Shipping Method Indicator. Possible values:

|

| Optional | deliveryTimeframe |

Integer [2] | Product delivery timeframe. Possible values:

|

| Optional | deliveryEmail |

String [1..254] | Target email address for delivery of digital distribution. Note that it is preferrable to pass the email in a separate email parameter of the request. The deliveryEmail parameter specified in this block is only used to fill MerchantRiskIndicator during 3DS authorization. |

Description of parameters in preOrderPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | preOrderDate |

String [10] | Expected date when delivery will be available (for pre-ordered purchases), in the format YYYYYYMMDD. |

| Optional | preOrderPurchaseInd |

Integer [2] | Indicator of a customer placing an order for available or future delivery. Possible values:

|

| Optional | reorderItemsInd |

Integer [2] | An indicator that the customer is rebooking a previously paid delivery as part of a new order. Possible values:

|

Description of parameters in orderPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | homePhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

|

| Optional | workPhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

|

| Conditional | mobilePhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

For payment by VISA with 3DS authorization, it is necessary to specify either phone or email of the cardholder. If you have a setting to display phone number on the payment page and have specified an invalid number, the customer will have a possibility to correct it on the payment page. |

Description of parameters in orderBundle object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | orderCreationDate |

String [19] | Order creation date in the following format: YYYY-MM-DDTHH:MM:SS. |

| Optional | customerDetails |

Object | Block containing customer attributes. The description of the tag attributes is given below. |

| Mandatory | cartItems |

Object | Object containing cart items attributes. The description of nested elements is given below. |

Description of parameters in customerDetails object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | contact |

String [0..40] | Customer's preferred way of communication. |

| Optional | fullName |

String [1..100] | Payer's full name. |

| Optional | passport |

String [1..100] | Customer's passport serial number in the following format: 2222888888. |

| Optional | deliveryInfo |

Object | Object containing delivery address attributes. The description of the nested elements is given below. |

Description of parameters in deliveryInfo object.

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | deliveryType |

String [1..20] | Delivery method. |

| Mandatory | country |

String [2] | Two letter code of the country of delivery. |

| Mandatory | city |

String [0..40] | City of destination. |

| Mandatory | postAddress |

String [1..255] | Delivery address. |

Description of parameters in cartItems object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | items |

Object | An element of the array containing cart item attributes. The description of the nested elements is given below. |

Description of parameters in items object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | positionId |

Integer [1..12] | Unique product identifier in the cart. |

| Mandatory | name |

String [1..255] | Name or the description of an item in any format. |

| Optional | itemDetails |

Object | Object containing the parameters describing an item. The description of the nested elements is given below. |

| Mandatory | quantity |

Object | Element describing the total of items of one positionId and its unit of measurement. The description of the nested elements is given below. |

| Optional | itemAmount |

Integer [1..12] | The total cost of all instances of one positionId specified in minor denomination of the currency. itemAmount must be passed only if the itemPrice parameter has not been passed. Otherwise passing of itemAmount is not required. If both parameters itemPrice and itemAmount are passed in the request, then itemAmount shall be equal itemPrice * quantity, otherwise the request will return an error. |

| Optional | itemPrice |

Integer [1..18] | Total cost of instance of one positionId specified in minor currency units. |

| Optional | itemCurrency |

Integer [3] | ISO 4217 currency code. If the parameter is not specified, it is considered to be equal to the Order currency. |

| Optional | itemCode |

String [1..100] | Number (identifier) of an item in the store system. |

Description of parameters in quantity object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | value |

Number [1..18] | Number of items in one positionId. Use a decimal point as a separator in fractions. Maximal number of decimal places is 3. |

| Mandatory | measure |

String [1..20] | The unit of measurement for the quantity of item instances. |

Description of parameters in itemDetails object.

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | itemDetailsParams |

Object | Parameter describing additional information regarding a line item. The description of the nested elements is given below. |

Description of parameters in itemDetailsParams object.

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | value |

String [1..2000] | Additional item info. |

| Mandatory | name |

String [1..255] | Name of the parameter describing the details of an item |

Description of parameters in the paymentFacilitator object:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | pfId |

String [1..11] | Payment facilitator identifier. |

| Mandatory | name |

String [1..40] | Payment facilitator name. |

| Optional | isoId |

String [1..11] | ISO identifier. |

| Mandatory | subMerchants |

Array of objects | The array of objects with the additional information about submerchants. See nested parameters below. |

Parameters of an object in subMerchants array:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | subMerchantId |

String [1..20] | Submerchant identifier. |

| Mandatory | name |

String [1..40] | Submerchant name. |

| Mandatory | address |

Object | A block with information about submerchant address. See nested parameters below. |

Parameters of the address object:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | city |

String [1..50] | Submerchant city. |

| Mandatory | postalCode |

String [1..16] | Submerchant postal code. |

| Mandatory | country |

Integer [2] | Submerchant country code in ISO 3166-1 format. |

| Optional | street |

String [1..40] | Submerchant street. |

Example of paymentFacilitator object:

"paymentFacilitator" :{

"pfId": "PF123456",

"name": "Payment Facilitator Name",

"isoId": "ISO789",

"subMerchants": [

{

"subMerchantId": "SM001",

"name": "Sub Merchant 1",

"address": {

"city": "City 1",

"postalCode": "101000",

"country": "US",

"street": "Street 1"

}

},

{

"subMerchantId": "SM002",

"name": "Sub Merchant 2",

"address": {

"city": "City 2",

"postalCode": "190000",

"country": "US",

"street": "Street 2"

}

}

]

}Response parameters

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | errorCode |

String [1..2] | Information parameter in case of an error, which may have different code values:

|

| Optional | errorMessage |

String [1..512] | Information parameter that is an error description in a case of error occurance. errorMessage value can vary, so it should not be hardcoded. Language of the description is set in language parameter of the request. |

| Optional | orderId |

String [1..36] | Order number in the payment gateway. Unique within the payment gateway. |

| Optional | formUrl |

String [1..512] | URL of the payment form, to which a customer will be redirected The URL is not returned if the registration of the order fails due to an error specified in errorCode. |

Examples

Request example

curl --request POST \

--url https://uat.dskbank.bg/payment/rest/registerPreAuth.do \

--header 'content-type: application/x-www-form-urlencoded' \

--data amount=2000 \

--data userName=test_user \

--data password=test_user_password \

--data returnUrl=https://mybestmerchantreturnurl.com \

--data orderNumber=1255555555555 \

--data clientId=259753456 \

--data language=enResponse example

{

"orderId": "01492437-d2fb-77fa-8db7-9e2900a7d8c0",

"formUrl": "https://uat.dskbank.bg/payment/merchants/pay/payment_en.html?mdOrder=01492437-d2fb-77fa-8db7-9e2900a7d8c0"

}Direct payments

Payment for order

To initiate payment on earlier registered order https://uat.dskbank.bg/payment/rest/paymentorder.do request is used.

Request is used in Internal 3DS Server mode, you don't need any additional permissions and/or certifications.

Request is used in External 3DS Server mode if you have agreement with Payment System or special Certificate, which alows you to perform 3DS authentacation on your own.

It means, that you can use your own 3DS Server to authenticate your client using 3D Secure technology. Read more about payment with your own 3DS Server here.

When sending the request, you should use the header:

Content-Type: application/x-www-form-urlencoded

Payment for order (internal 3DS Server)

Payment is initiated using payment card data and using 3DS authentication (authentication is regulated by permissions, managed by Support).

Request parameters

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | userName |

String [1..100] | Merchant's API account login. |

| Mandatory | password |

String [1..30] | Merchant's API account password (mandatory, unless token is passed). If you pass your login and password to authenticate in the payment gateway, do not pass token parameter. |

| Mandatory | MDORDER |

String [1..36] | Order number in the payment gateway. |

| Mandatory | $PAN |

Integer [1..19] | Payment card number. Mandatory, if seToken is not passed. |

| Mandatory | $CVC |

String [3] | CVC/CVV2 code on the back of a payment card. Mandatory, if seToken is not passed. Only digits are allowed. |

| Mandatory | YYYY |

Integer [4] | Payment card expiry year. If seToken is not passed, it is mandatory to pass either $EXPIRY or YYYY and MM. |

| Mandatory | MM |

Integer [2] | Payment card expiry month. If seToken is not passed, it is mandatory to pass either $EXPIRY or YYYY and MM. |

| Conditional | $EXPIRY |

Integer [6] | Card expiration in the following format: YYYYMM. Overrides YYYY and MM parameters. If seToken is not passed, it is mandatory to pass either $EXPIRY or YYYY and MM. |

| Conditional | seToken |

String | Encrypted card data that replaces $PAN, $CVC, and $EXPIRY (or YYYY,MM) parameters. Must be passed if used instead of the card data. The mandatory parameters for seToken string are timestamp, UUID, PAN, EXPDATE, MDORDER. Click here for more information about seToken generation. If seToken contains encrypted data about a stored credential ( bindingId), the paymentOrderBinding.do request should be used for payment instead of paymentorder.do. |

| Mandatory | TEXT |

String [1..512] | Cardholder name. |

| Mandatory | language |

String [2] | ISO 639-1 encoded language key. If the language is not specified, the default language specified in the store settings is used. Supported languages: en,ru,el,ro,bg,pt,sw,hu,it,pl,de,fr,kh,cn,es,ka,da,et,fi,lt,lv,nl,sv. |

| Optional | ip |

String [1..39] | Buyer's IP address. IPv6 is supported in all requests. (up to 39 characters). |

| Optional | bindingNotNeeded |

Boolean | Allowed values:

|

| Optional | jsonParams |

Object | A set of additional free-form attributes, structure: jsonParams={"param_1_name":"param_1_value",...,"param_n_name":"param_n_value"}.These fields can be passed to the Processing Center for further processing (additional setup is needed, please contact Support). If you use your own 3DS Server the payment gateway expects that every paymentOrder request will include the following additional parameters such as eci, cavv, xid etc. Please refer here for more information.To initiate 3RI authentication in case when there is no stored credentials, you may need to pass a number of additional parameters (see 3RI authentication for details). Some pre-defined jsonParams attributes:

|

| Optional | threeDSSDK |

Boolean | Possible values: true or false. Flag showing that payment comes from 3DS SDK. |

| Conditional | email |

String [1..40] | Email to be displayed on the payment page. Customer's email must be passed if client notification is configured for the merchant. Example: client_mail@email.com. For payment by VISA with 3DS authorization, it is necessary to specify either phone or email of the cardholder. |

| Optional | mcc |

Integer [4] | Merchant Category Code. Using this parameter requires a special permission. You can use only the values from the predefined list of allowed MCC values. Contact the support team for details. |

| Optional | mvv |

String [1..10] | Merchant verification value from Mastercard for tokenized transactions. To pass this parameter, a special setting must be enabled (contact technical support). |

| Optional | paymentFacilitator |

Object | A block with the parameters of a payment facilitator, i.e. a merchant who allows several submerchants to accept payments under its account. This parameter is used if a special setting is enabled (contact the support team). See nested parameters. |

| Optional | billingPayerData |

Object | A block with the client's registration data (address, postal code) necessary for passing the address verification within the AVS/AVV services. Mandatory if the feature is enabled for the merchant on Payment Gateway side. See nested parameters. |

| Optional | shippingPayerData |

Object | Object containing customer delivery data. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | preOrderPayerData |

Object | Object containing pre-order data. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | orderPayerData |

Object | Object containing data about the order payer. It is used for further 3DS authentication of the client. See nested parameters. |

| Optional | tii |

String | Transaction initiator indicator. A parameter indicating what type of operation will be carried out by the initiator (Customer or Merchant). Possible values |

| Optional | externalScaExemptionIndicator |

String | The type of SCA (Strong Customer Authentication) excemption. If this parameter is specified, the transaction will be processed depending on your settings in the payment gateway: either forced SSL operation will be done, or the issuer bank will get the information about SCA excemption and decide to perform operation with or without 3DS authentication (for details, contact our support team). Allowed values:

To pass this parameter, you must have sufficient permissions in the payment gateway. |

| Optional | clientBrowserInfo |

Object | A block with the data about the client's browser that is sent to ACS during the 3DS authentication. To pass this block, you should have a special setting (contact the support team). See nested parameters. |

| Conditional | originalPaymentNetRefNum |

String [1..36] | The identifier of the original or previous successful transaction in the payment system in relation to the performed stored-credential transaction - TRN ID. Is passed when tii = R,U, or F.Is mandatory when using merchant's stored credentials in stored credential transfers. |

| Conditional | originalPaymentDate |

String | Date of initiating transaction. The format is Unix timestamp, in milliseconds. Is passed when tii = R,U, or F. |

Below are the parameters of the billingPayerData block (data about the client registration address).

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | billingCity |

String [0..50] | The city registered on a specific card of the Issuing Bank. |

| Optional | billingCountry |

String [0..50] | The country registered on a specific card of the Issuing Bank. Format: ISO 3166-1 (Alpha 2 / Alpha 3 / Number-3) or the country name. We recommend to pass a two/three-letter ISO country code. |

| Optional | billingAddressLine1 |

String [0..50] | The address registered on a specific card of the Issuing Bank (A payer’s address). Line 1. Mandatory to be passed in order AVS verification works. |

| Optional | billingAddressLine2 |

String [0..50] | The address registered on a specific card of the Issuing Bank. Line 2. |

| Optional | billingAddressLine3 |

String [0..50] | The address registered on a specific card of the Issuing Bank. Line 3. |

| Optional | billingPostalCode |

String [0..9] | Postal code registered on a specific card of the Issuing Bank. Mandatory to be passed in order AVS verification works. |

| Optional | billingState |

String [0..50] | The state registered on a specific card of the Issuing Bank. Format: full ISO 3166-2 code, its part, or the state/region name. Can contain Latin characters only. We recommend to pass a two-letter ISO state code. |

| Mandatory | payerAccount |

String [1..32] | Payer's account number. |

| Optional | payerLastName |

String [1..64] | Payer's last name. |

| Optional | payerFirstName |

String [1..35] | Payer's first name. |

| Optional | payerMiddleName |

String [1..35] | Payer's middle name. |

| Optional | payerCombinedName |

String [1..99] | Payer's full name. |

| Optional | payerIdType |

String [1..8] | Type of the payer's identifying document provided. Allowed values:

|

| Optional | payerIdNumber |

String [1..99] | Number of the payer's identifying document provided. |

| Optional | payerBirthday |

String [1..20] | Payer's birth date in the YYYYMMDD format. |

Description of parameters in shippingPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | shippingCity |

String [1..50] | The customer's city (from the delivery address) |

| Optional | shippingCountry |

String [1..50] | The customer's country |

| Optional | shippingAddressLine1 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingAddressLine2 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingAddressLine3 |

String [1..50] | The customer's primary address (from the shipping address) |

| Optional | shippingPostalCode |

String [1..16] | The customer's zip code for delivery |

| Optional | shippingState |

String [1..50] | Customer's state/region (from delivery address) |

| Optional | shippingMethodIndicator |

Integer [2] | Shipping Method Indicator. Possible values:

|

| Optional | deliveryTimeframe |

Integer [2] | Product delivery timeframe. Possible values:

|

| Optional | deliveryEmail |

String [1..254] | Target email address for delivery of digital distribution. Note that it is preferrable to pass the email in a separate email parameter of the request. The deliveryEmail parameter specified in this block is only used to fill MerchantRiskIndicator during 3DS authorization. |

Description of parameters in preOrderPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | preOrderDate |

String [10] | Expected date when delivery will be available (for pre-ordered purchases), in the format YYYYYYMMDD. |

| Optional | preOrderPurchaseInd |

Integer [2] | Indicator of a customer placing an order for available or future delivery. Possible values:

|

| Optional | reorderItemsInd |

Integer [2] | An indicator that the customer is rebooking a previously paid delivery as part of a new order. Possible values:

|

Description of parameters in orderPayerData object:

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | homePhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

|

| Optional | workPhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

|

| Conditional | mobilePhone |

String [7..15] | Customer's phone number. It is always necessary to specify the country code, but you can specify or omit the + sign or 00 at the beginning. The number must be 7 to 15 digits long. Thus, the following options are valid:

For payment by VISA with 3DS authorization, it is necessary to specify either phone or email of the cardholder. If you have a setting to display phone number on the payment page and have specified an invalid number, the customer will have a possibility to correct it on the payment page. |

Possible values of tii (read about the stored credential types supported by the Payment Gateway here):

tii value |

Description | Transaction type | Transaction initiator | Card data for transaction | Card data saved after transaction | Note |

|---|---|---|---|---|---|---|

| Empty | Regular | Customer | Entered by Customer | No | An e-commerce transaction, credential is not stored. | |

| CI | Initial Common CIT | Initiating | Customer | Entered by Customer | Yes | An e-commerce transaction, credential is stored. |

| F | Unscheduled CIT | Subsequent | Customer | Customer selects card instead of manual entry | No | An e-commerce transaction that uses a stored credential. |

| U | Unscheduled MIT | Subsequent | Merchant | No manual entry, Merchant passes the data | No | An e-commerce transaction that uses a stored credential |

| RI | Initial Recurrent CIT | Initiating | Customer | Entered by Customer | Yes | An e-commerce transaction, credential is stored. |

| R | Recurrent MIT | Subsequent | Merchant | No manual entry, Merchant passes the data | No | A recurrent transaction that uses a stored credential. |

| II | Initial Installment CIT | Initiating | Customer | Entered by Customer | Yes | An e-commerce transaction, credential is stored. |

| I | Installment MIT | Subsequent | Merchant | No manual entry, Merchant passes the data | No | An installment transaction that uses a stored credential. |

Below are the parameters of the clientBrowserInfo block (data about the client's browser).

| Required | Name | Type | Description |

|---|---|---|---|

| Optional | userAgent |

String [1..2048] | Browser agent. |

| Optional | OS |

String | Operation system. |

| Optional | OSVersion |

String | Operation system version. |

| Optional | browserAcceptHeader |

String [1..2048] | The Accept header that tells the server what file formats (or MIME-types) the browser accepts. |

| Optional | browserIpAddress |

String [1..45] | Browser IP address. |

| Optional | browserLanguage |

String [1..8] | Browser language. |

| Optional | browserTimeZone |

String | Browser time zone. |

| Optional | browserTimeZoneOffset |

String [1..5] | The time zone offset in minutes between the user's local time and UTC. |

| Optional | colorDepth |

String [1..2] | Screen color depth, in bits. |

| Optional | fingerprint |

String | Browser fingerprint - a unique digital identifier of the browser. |

| Optional | isMobile |

Boolean | Possible values: true or false. Flag showing that a mobile device is used. |

| Optional | javaEnabled |

Boolean | Possible values: true or false. Flag showing that java is enabled in the browser. |

| Optional | javascriptEnabled |

Boolean | Possible values: true or false. Flag showing that javascript is enabled in the browser. |

| Optional | plugins |

String | Comma-separated list of plugins the browser uses. |

| Optional | screenHeight |

Integer [1..6] | Screen height, in pixels. |

| Optional | screenWidth |

Integer [1..6] | Screen width, in pixels. |

| Optional | screenPrint |

String | Data about current screen print including resolution, color depth, display metrics. |

| Optional | device |

String | Information about the cardholder's device (model, version, and so on). |

| Optional | deviceType |

String | Type of device on which the browser is running (mobile phone, desktop, tablet, and so on). |

Example of clientBrowserInfo block:

"clientBrowserInfo":

{

"userAgent":"Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/111.0.0.0 Safari/537.36 Edg/111.0.1661.41",

"fingerprint":850891523,

"OS":"Windows",

"OSVersion":"10",

"isMobile":false,

"screenPrint":"Current Resolution: 1536x864, Available Resolution: 1536x824, Color Depth: 24, Device XDPI: undefined, Device YDPI: undefined",

"colorDepth":24,

"screenHeight":"864",

"screenWidth":"1536",

"plugins":"PDF Viewer, Chrome PDF Viewer, Chromium PDF Viewer, Microsoft Edge PDF Viewer, WebKit built-in PDF",

"javaEnabled":false,

"javascriptEnabled":true,

"browserLanguage":"it-IT",

"browserTimeZone":"Europe/Rome",

"browserTimeZoneOffset":-120,

"browserAcceptHeader":"gzip",

"browserIpAddress":"x.x.x.x"

}Description of parameters in the paymentFacilitator object:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | pfId |

String [1..11] | Payment facilitator identifier. |

| Mandatory | name |

String [1..40] | Payment facilitator name. |

| Optional | isoId |

String [1..11] | ISO identifier. |

| Mandatory | subMerchants |

Array of objects | The array of objects with the additional information about submerchants. See nested parameters below. |

Parameters of an object in subMerchants array:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | subMerchantId |

String [1..20] | Submerchant identifier. |

| Mandatory | name |

String [1..40] | Submerchant name. |

| Mandatory | address |

Object | A block with information about submerchant address. See nested parameters below. |

Parameters of the address object:

| Required | Name | Type | Description |

|---|---|---|---|

| Mandatory | city |

String [1..50] | Submerchant city. |

| Mandatory | postalCode |

String [1..16] | Submerchant postal code. |

| Mandatory | country |

Integer [2] | Submerchant country code in ISO 3166-1 format. |

| Optional | street |

String [1..40] | Submerchant street. |

Example of paymentFacilitator object:

"paymentFacilitator" :{